制频强制索权等问题突出

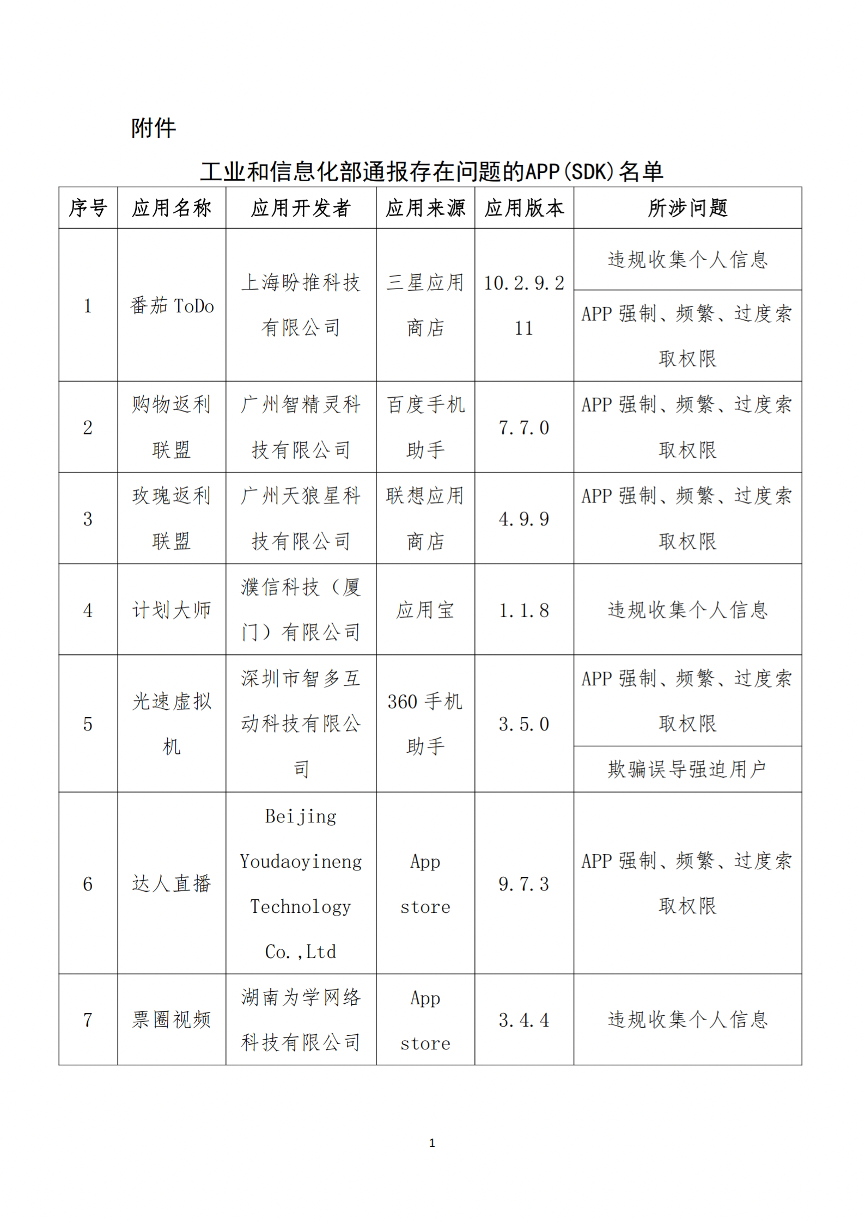

中国消费者报北京讯(记者武晓莉)日前,工信工业和信息化部公布了今年第7批存在侵害用户权益行为的部通报款APP及SDK通报名单,共13款,问题其中包括番茄ToDo(10.2.9.211)、强权问达人直播(9.7.3)等知名APP,制频强制索权等问题突出。繁索

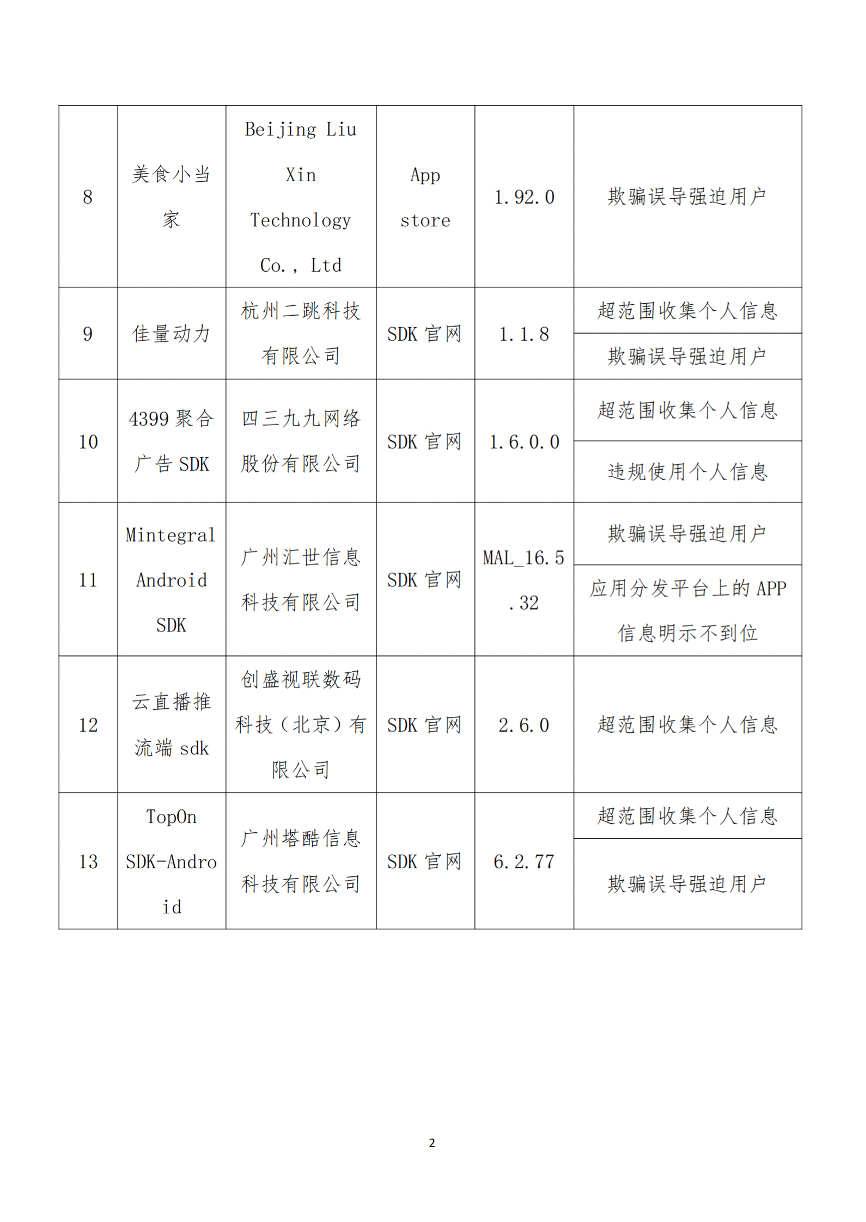

通报显示,题突工业和信息化部近期组织第三方检测机构对实用工具、工信在线影音等移动互联网应用程序(APP)及第三方软件开发工具包(SDK)进行检查,部通报款发现13款存在侵害用户权益行为的问题APP及SDK。在13款APP及SDK中,强权问存在强制、制频频繁、繁索过度索取权限问题的题突APP有5款,包括番茄ToDo(10.2.9.211)、工信购物返利联盟(7.7.0)、玫瑰返利联盟(4.9.9)等;存在欺骗、误导、强迫用户问题的有5款,包括光速虚拟机(3.5.0)、美食小当家(1.92.0)、佳量动力(1.1.8)等。

此外,4399 聚合广告 SDK(1.6.0.0)、云直播推流端 sdk(2.6.0)等4款APP及SDK,存在超范围收集个人信息的问题;票圈视频(3.4.4)、计划大师(1.1.8)等3款APP存在违规收集个人信息问题;MintegralAndroid SDK(MAL 16.532)在应用分发平台上的APP信息明示不到位。

此次通报的8款APP和5款SDK,有3款来自APP store,其他5款分别来自三星应用商店、百度手机助手、联想应用商店、应用宝以及360手机助手,被通报的SDK均来自SDK官网。

工业和信息化部要求,上述APP及SDK应按有关规定进行整改,对于整改落实不到位的,将依法依规组织开展相关处置工作。